Imagine an investor walking into your office for the first time. After a short exchange of pleasantries and introductions, you go through your standard conversation-starter questions. Then, in some form or another, you explain to the client the services you offer, hoping to convince the client to hire you. According to our research, how you explain your services can have an impact on a person’s hiring decision. And if you focus only on the cold, hard facts, you may be deterring some investors.

What Motivates an Investor to Hire Their Advisor?

We gathered and analyzed data from 312 current advisor clients where we asked them to “Please list some reason why you hired your advisor.” The question was open-ended, allowing us to collect people’s thoughts in their own words. Since we collected the data using an online survey platform, the responses were also less susceptible to social desirability bias—our tendency to respond to a question in a way that conforms to societal norms. In the real world, when you ask an investor what brought them into your office, their answer may be swayed by who’s in the room—you and maybe a spouse/loved one. The online environment of our survey took that pressure away. In all, when we asked people why they hired their financial advisors, their responses were much more emotionally grounded than we anticipated.

Top Reasons Clients Hire Their Advisors

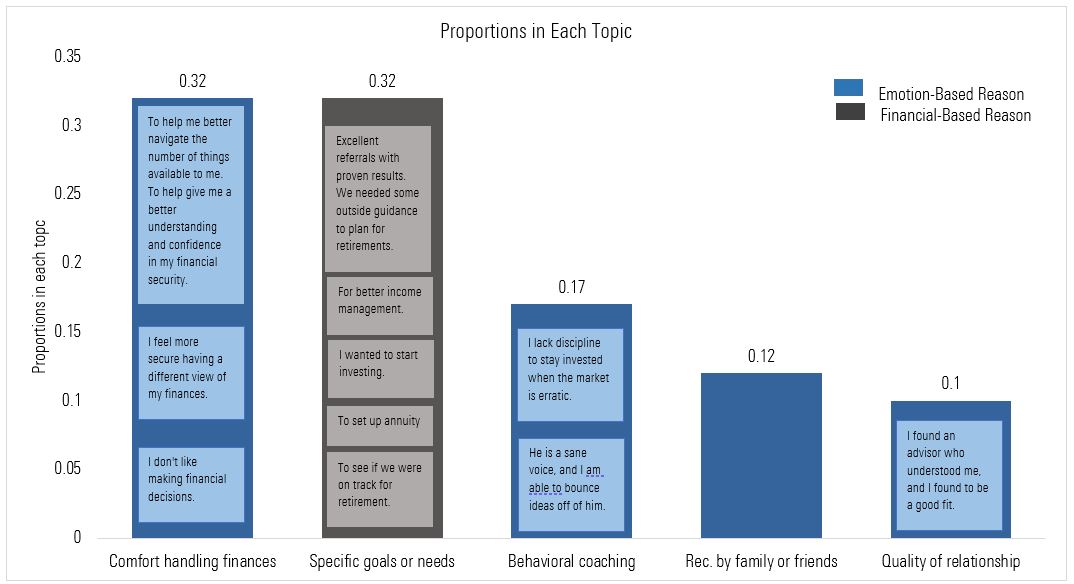

Exhibit 1 shows the five most common reasons for hiring an advisor, with each bar showing a few responses that fit into each category. The bars in the exhibit are color-coded by whether the motivation can be considered emotionally or financially grounded.

Proportion in each topic

How to Address These Needs in Your Practice

Our research points to the importance of addressing a client’s emotional needs during beginning conversations, but that is easier said than done. Although three in five clients may end up hiring an advisor for an emotionally grounded reason, we can’t expect investors to be forthright about their need for emotional support. Instead, advisors must address these needs in a subtle and tactful manner, which can involve addressing the key reasons we cited above. To help advisors incorporate these insights into their communications, we created a Value Prop Makeover Exercise. Download the full paper to dive deeper into the research and gain access to the exercise.

We can help take the effort out of this for you by demonstrating how this would work for you and your family and providing you with one cohesive Holistic Lifestyle Financial Plan.

You can arrange a meeting by clicking here to access my diary, email info@smartfinance.ie or call 087 8144 104.