Putting hard-earned money in the stock market can make some people nervous.

It’s well known that a correction can occur at any time, and the fear of market crashes can make even the most seasoned investors to make questionable decisions.

While it’s true that putting your money on the line is never easy, the historical record of the stock market is virtually irrefutable: U.S. markets have consistently performed over long holding periods, even going back to the 19th century.

Market Performance (1872-2018)

Today’s animation comes to us from The Measure of a Plan, and it shows the performance of the U.S. market over different rolling time horizons using annualized returns.

Note: The animation uses real total returns from the S&P Composite Index from 1872 to 1957, and then the S&P 500 Index from 1957 onwards. Data has been adjusted for reinvestment of dividends as well as inflation.

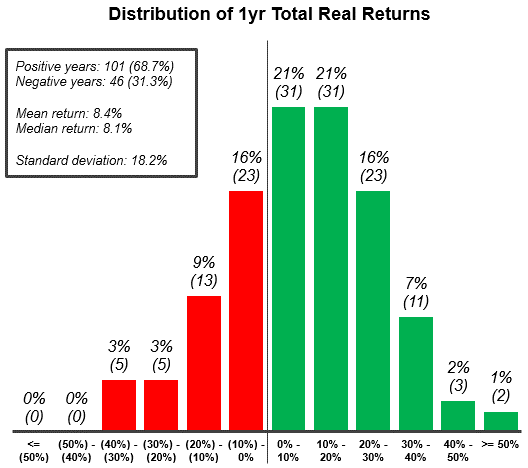

Using just one-year intervals of time, the market can be a crapshoot. Unfortunately, if you were to just choose a one-year period at random, there would be a significant chance of losing money.

However, as the timeframes get longer – the animation goes to 5-year, 10-year, and then 20-year rolling periods – the frequency of losses rapidly decreases. By the time you get to the 20-year windows, there isn’t a single instance in which the market had a negative return.

Why Time Matters

Over 146 years of data, the chance of seeing negative returns for any given year is about 31%.

That fact in itself is quite alarming, but even more important to note is the distribution of returns in those down years. As you can see in the following chart also from The Measure of a Plan, it’s not uncommon for a down year to skew in the high negatives, just as it did during the crisis of 2008:

According to the data, there have been 10 individual years where the market has lost upwards of 20% – and while those off years are greatly outnumbered by the years with positive returns, it makes it clear that timeframe matters.

Past performance obviously doesn’t guarantee future results, but the historical track record in this case is quite robust.

Long-term investors can see that as long as their time horizon is measured in the decades, you can take the odds of making money in the stock market to the bank.

Source: March 11, 2019, Jeff Desjardins.

How we help

We can help take the effort out of this for you by demonstrating how this would work for you and your family and providing you with one cohesive Financial Plan.

You can arrange a meeting by clicking here to access my diary, email info@smartfinance.ie or alternatively, call me on 087 8144 104.