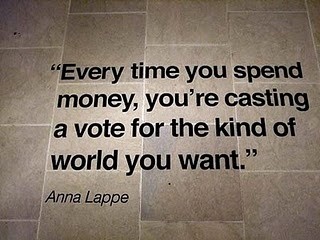

There are two ways to use money. One is as a tool to live a better life. The other is as a yardstick of status to measure yourself against others. Many people aspire for the former but get caught up chasing the latter.

Money is a tool you can use. But if you’re not careful, it will use you. Sometimes the stuff you spend money on has so much influence over your autonomy and sanity that it’s not clear whether you own things or the things own you.

Everyone can spend money in a way that will make them happier, but there is no universal formula on how to do it. The nice stuff that makes me happy might seem crazy to you, and vice versa. Like many things in finance, debates over what kind of lifestyle you should live are often just people with different personalities talking over each other.

How you spend money can be a reflection of what you’ve experienced in life. To someone who grew up snubbed by poverty, owning a fancy car might be the ultimate symbol of what you’ve overcome. To an old-money family, it might be the ultimate symbol of ego and insecurity. People don’t just spend money on things they find fun or useful. Their decisions often reflect the psychological wounds of their life experiences.

Spending money can buy happiness, but it’s often an indirect path. The big, nice house might make you happier, but mostly because it makes it easier to spend time with friends and family, and the friends and family are actually what are making you happy.

Unspent money buys something intangible but valuable: freedom, independence, autonomy, and control over your time. Every dollar of savings buys a claim check on the future.

At the same time, some wealthy people struggle to spend money on things that would make them happy because “I’m a saver” becomes such an ingrained part of their identity. What you intended to be a strategy to achieve a better life turns into an ideology you are beholden to.

There are cases when people’s desire to show off fancy stuff is because it’s their only way to gain respect and admiration. Everyone wants respect and admiration, a feeling that they matter and are needed. Some people who feel they aren’t getting respect for their intelligence, humor, wisdom, or ability to love resort to trying to get it by impressing you with their car, house, or clothes.

Nothing is as desired as much as the thing you want but can’t have. Material goods that play hard to get mess with our heads the same way people do. When something you like is just out of reach – you can almost afford it, but not quite yet – it takes on a mystique and exaggerates the dreams you have about how much that thing will make you happy and solve your problems.

Aspirations trickle down. Kevin Kelly once made the point that if you want to know what lower-income groups will aspire to spend their money on in the future, look at what higher-income groups do today. European vacations were once the exclusive playground of the rich. Then they trickled down. Same with college, investing in the stock market, two-car households, lawns, walk-in closets, and six-burner stoves – what was once a luxury of the rich became standards of the masses.

There is no such thing as an objective level of wealth. Everything is relative to someone else. People look around and say, “What’s that person driving, where are they living, what kind of clothes are they wearing?” Aspirations are calibrated accordingly.

There’s a difference between nice stuff and fancy stuff. One provides tangible utility, the other offers social utility. Someone once noted that a high-end Toyota is a better car than an entry-level BMW, because the nice Toyota is filled with things that make driving more pleasant, while the entry-level BMW is mostly just status and bragging rights. Using money to buy nice stuff is great. Fancy stuff is a different, more complicated, animal.

The more money you have, the harder it becomes to know how to spend it in a way that will make you happy. And that confusion sets in at fairly low levels of income. Luke Burgis writes: “After meeting our basic needs as creatures, we enter into the human universe of desire. And knowing what to want is much harder than knowing what to need.”

Source: Morgan Housel, Collab Fund, January 31st 2024.

How we help

We can help take the effort out of this for you by demonstrating how this would work for you and your family and providing you with one cohesive Holistic Lifestyle Financial Plan.

You can arrange a meeting by clicking here to access my diary, email info@smartfinance.ie or call 087 8144 104.