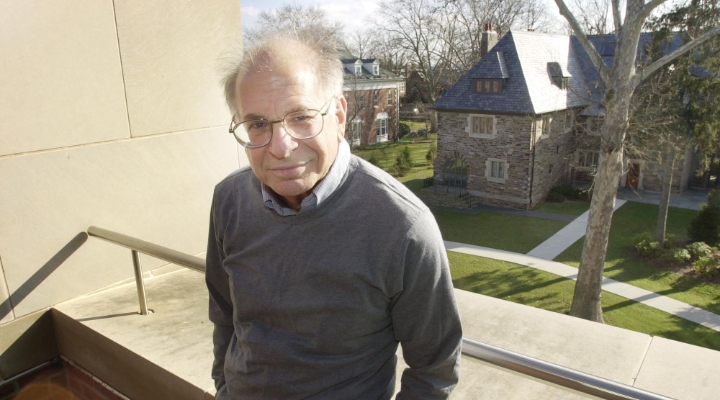

Daniel Kahneman, 1934-2024: The Unlikely Economist

Nothing in his early life suggested that Daniel Kahneman, who died last week at the age of 90, would eventually win a Nobel Prize in economics. To start, the 2002 Nobel laureate was trained in another subject. His PhD dissertation, in psychology, analysed a ratings scale called the semantic differential. That measure helps researchers, such as product